COVID-19 continues to be the dominant topic of 2020, creating uncertainty in the capital markets and prompting government intervention. Please enjoy our quarterly newsletter addressing these issues and more.

COMMERCIAL REAL ESTATE NEWS

2020 CRE Midyear Outlook: Weathering the Storm Ahead

COVID-19 has accelerated the shift to e-commerce, underscored the need for affordable housing and forced commercial real estate owners to rethink workplaces in light of social distancing guidelines.

JPMorgan Chase – Full Article Here

How CARES Impacts Multifamily Real Estate Loans

It has been about three months since the COVID-19 emergency was declared by President Donald Trump. It’s still too early to fully understand its impact on multifamily real estate, but matters should become clearer once June rents come due.

Yield PRO Magazine – Full Article Here

Rent Deferral In The Time of COVID-19

When it comes to commercial tenants that cannot pay rent, owners need to apply empathy as well as solid legal counsel…

Commercial Property Executive – Full Article Here

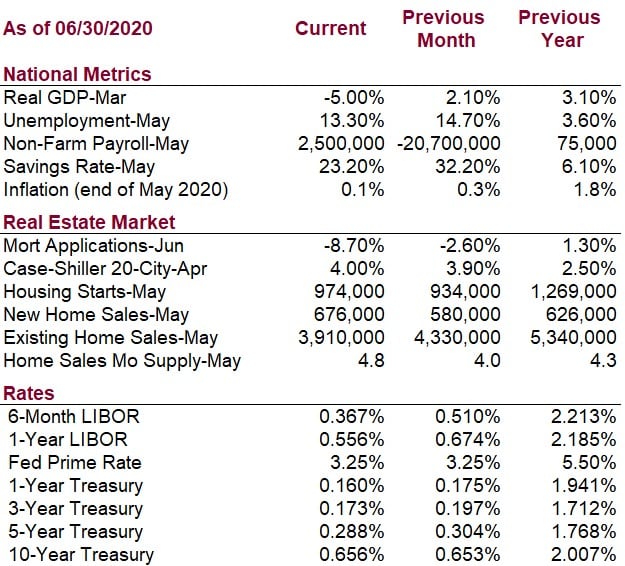

ECONOMIC DATA

BORROWER EDUCATION

COVID-19 Economic Relief Update

SBA Paycheck Protection Program (PPP) funds are still available, and the deadline to submit an application has been extended to August 8, 2020. There are other assistance programs available like the Economic Injury Disaster Loan. AAI Financial is offering FREE assistance in applying for these programs. To date, AAI Financial has helped businesses obtain $8.6 million in funds.

If you received PPP funds, it is time to start considering loan forgiveness. There have been several changes to the forgiveness rules since the beginning of the program:

- Borrowers have the option to extend the 8-weeks to 24-weeks for payroll costs to retain and rehire employees

- The 75% required to be used on payroll expenses has been reduced to 60% of the total loan amount. Therefore, the cap for forgivable, non-payroll expenses has increased from 25% to 40%

- The June 30th deadline for penalties and calculations for reductions in workforce has been extended to December 31st

- Additional exceptions where the borrower made good faith effort and can document one of the following situations:

- The employer unable to rehire former employees or similarly qualified new employees,

- The business was unable to restore business operations due to federal health guidelines and/restrictions related to COVID-19

- Extended loan repayment period from 2 years to 5 years. This maintains an interest rate of 1%

- Borrowers will be eligible for a 2-year deferral of employer’s share of Social Security payroll taxes

Additionally, a new EZ PPP loan forgiveness application form is available if your business meets certain criteria. The form can be downloaded here and instructions, including criteria for use of the form, can be found here.

While the information above is intended to be accurate, programs are rapidly evolving. Please contact AAI Financial, your PPP lender, or consult SBA and US Treasury websites for updated information.

AAI Financial can assist you in preparing your forgiveness application. Remember, the forgiveness application, once completed, needs to be submitted to the PPP lender you are working with.

RECENTLY FUNDED TRANSACTIONS

Here are examples of opportunities we assisted our clients with last quarter:

- $1,874,500 Multi Family Cash-Out Refinance – Multiple Locations in WA – 75% LTV

- $683,000 Gas Station/C-Store Cash-Out Refinance in Cowiche, WA – 65% LTV

- $747,500 Owner Occupied Office Cash-Out Refinance in Yakima, WA – 65% LTV

Contact us to learn how we can help you with your commercial property financing.

Let's talk.

We are knowledgeable, easy to talk to, and give free advice.

Please contact us to see how we can work together.

Or email us.