Rising rates, inflation and a potential recession are recurring themes in the daily news. This issue focuses on what this mean for commercial real estate. Please enjoy our quarterly newsletter addressing these issues and more.

COMMERCIAL REAL ESTATE NEWS

What a Recession Could Mean for Commercial Real Estate

Experts from Moody’s Analytics, JPMorgan Chase and across the industry discuss how real estate investors can prepare for an economic downturn.

Full Article from JP Morgan Insights

These Factors Could Jumpstart CRE Transactions

We should expect a more active Q4 2022 than what we have seen in Q2 and Q3 for several reasons. There remains an abundance of capital and liquidity in the market, and several motivators exist that should be considered by anyone sitting on the sidelines as we come out of the Labor Day holiday into the homestretch. Here’s a few of those motivators to consider.

Full Article from Commercial Property Executive

Multifamily Rents Drop

The anticipated slowdown is no surprise to analysts, who observe in a new report that the U.S. economy is starting to feel the effects of higher interest rates, while migration is slowing and affordability is affecting high-growth metros.

Full Article from Yardi

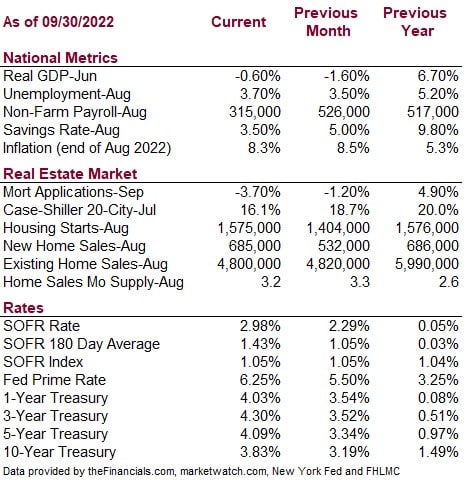

ECONOMIC DATA

LIBOR rates are no longer being published in AAI Quarterly Newsletter.

In 2017 in the United States, the Alternative Reference Rates Committee (ARRC), convened by the Federal Reserve Board, officially endorsed the Secured Overnight Financing Rate (SOFR) as the preferred benchmark interest reference rate replacing LIBOR. SOFR’s price is based on borrowing rates for overnight U.S. Treasury repurchase agreements, or repos.

On March 5, 2021, the Financial Conduct Authority, the financial services regulator in the UK, announced the cessation of LIBOR.

Articles With More Information:

BORROWER EDUCATION

How Banks React to Rising Rates

Starting in March 2022, we have seen the Fed raise the Fed Funds interest rates 5 times by a total of 300 basis points. But what does that mean for commercial real estate investors? How this impacts commercial real estate depends on lenders and how they react to the rate increases.

The Fed Funds rate is the rate banks can borrow from the federal government. As the Fed Funds rate goes up, banks typically increase the Prime Rate, the rate used as a basis for many types of bank loans such as home equity loans and lines of credit. This is similar to businesses passing on increased costs to their customers. The Prime Rate has risen from 3.25% to 6.25%. Therefore, the rate on all variable rate loans based on Prime have increased as well. SBA loans are often based on prime, meaning the rates on many SBA loans and the rate offered on new SBA loans has also increased.

Longer term loans, like term loans for real estate, are more likely to be based on other measures like the 5 year or 10-year treasury bills. Treasury bills do not move in lock step with the Fed Funds rate. Rates are based on market supply and demand, and the expectation of future short-term rates. The Fed has been selling long term bonds, which increases supply. By increasing supply, sellers need to increase rates to entice more demand. As the Fed raises the Fed Funds rate, the expectation of high short-term rates in the future also increases, causing long term rates to rise. This is why rates offered on long term commercial real estate loans has increased, but at a different pace than Prime.

When rates like Prime and treasuries increase, lenders are quick to follow by raising loan rates. However, they are slow to increase deposit rates. Rates on savings accounts and term deposits often increase later and more slowly than loan rates. This allows banks to increase their spread and earn more profits.

In addition, many lenders are running low on deposits. The multiple forms of stimulus during COVID increased deposits on hand at banks, and banks were anxious to lend the funds out. Deposits available to lend has decreased recently due to funds already being loaned out and depositors withdrawing funds to make purchases or pay for higher costs of living. As deposits become less available to banks for lending, banks increase rates to ensure the loans they do make are profitable.

Currently there is talk of recession due to the rapid increase in rates. Real estate prices in a recessionary environment with high interest rates tend to fall. In periods like this, banks will become more conservative in their lending practices by working more closely with borrowers they already have a relationship with, and are less inclined to lend to new borrowers. They also decrease the loan to value they are willing to lend and decrease the length of amortization they are willing to offer. Both of these changes in terms protect the lender against the potential of falling real estate prices.

RECENTLY FUNDED TRANSACTIONS

Here are examples of opportunities we assisted our clients with last quarter:

- $12,610,500 Multifamily Construction – Pasco, WA – 75% LTC

- $1,515,500 Warehouse Cash Out Refi – Pasco, WA – 60% LTV

- $400,000 Multitenant Office Purchase / Renovation – Yakima, WA – 75% LTC

Let's talk.

We are knowledgeable, easy to talk to, and give free advice.

Please contact us to see how we can work together.

Or email us.