Rising interest rates and inflation are impacting commercial lending causing borrowers to rethink their investments, how they borrow and who they borrow from. Please enjoy our quarterly newsletter discussing these themes, their impact on your business, and more.

COMMERCIAL REAL ESTATE NEWS

Despite a Cooling Housing Market, Home Prices and Rents Remain High

The annual State of the Nation’s Housing report from the Harvard Joint Center for Housing Study (JCHS) highlights the growing housing affordability crisis, despite a slowdown in housing prices.

National Association of Homebuilders – Full Article Here

Reverse 1031 Exchanges: The Benefits, Risks, and Tax Opportunities Real Estate Investors Need to Know

In a reverse 1031 exchange, replacement property is acquired prior to the sale of relinquished property. This contrasts with a forward 1031 exchange, where the relinquished property is first sold and after which a replacement property is identified and acquired.

EisnerAmper – Full Article Here

Fed: Bank officers expect lending to tighten through rest of 2023

Banks tightened lending standards for businesses and households during the first quarter and expect to keep tightening for the rest of 2023, according to the Federal Reserve’s quarterly survey of senior loan officers.

Yahoo! Finance – Full Article Here

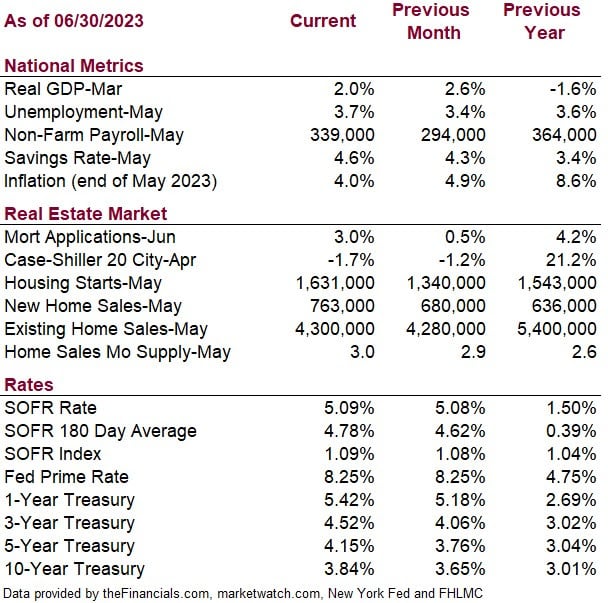

ECONOMIC DATA

BORROWER EDUCATION

How Lenders are Tightening

Over the past several months, Fed Chair Powell has stated that stresses in the banking sector, tighter credit conditions and banks reducing the pace of lending will help reduce inflation. But what do these changes in the banking sector mean for commercial loans?

Before defining the various changes that are happening, it is important to look at why changes are happening. One of the important factors is liquidity. During and shortly after COVID, banks were flush with deposits and sitting on a lot of cash. Both consumers and businesses received a significant amount of stimulus and deposited these excess funds with financial institutions. Banks were eager to lend the money out. We have reached a point where depositors are now using their savings and financial institutions have loaned out the excess deposits that were on hand. Also, borrowers with low rates from prior years are less likely to pay off or refinance their loans early at higher rates, which means less liquidity coming into the financial institution. The liquidity of financial institutions has decreased dramatically. With less funds available to lend, lenders are more discerning about who they lend to.

Another factor is the rise in interest rates. Loans made a couple years ago when lenders had too much liquidity were made at low rates. Now a lender may need to borrow money to make their next loan. Rates have risen to the point where a lender may need to borrow at a higher rate today than the rate they gave to borrowers just a few years ago. To combat this, some lenders are changing the way they price loans (charge rates) based on their cost to borrow funds from the FHLB or an “internally calculated cost of funds” rather than the more traditional 5-year treasury bill. They also are increasing the margin over the 5-year treasury or cost of funds in case rates continue to rise.

Due to limited liquidity, many lenders are now requiring deposits in order to receive a loan. It may come in the form of always keeping a certain number of months of payment on deposit or require moving all operating deposits to the institution. Requiring borrowers to deposit funds helps lenders replenish their liquidity.

Another method lenders are using to “tighten credit” is to decrease loan amortization. Amortization is the length of time of the loan used to calculate the payment. In some markets a 25-year amortization has become 20 years, and some lenders have gone to only offering 15-year amortization. The lower the amortization, the more quickly the loan needs to be repaid, so the payment amount is higher. A higher required payment can disqualify borrowers that may have been qualified in prior years at longer amortizations.

Some lenders have stopped allowing loans based on forecast cash flows, instead approving only loans that cash flow now and historically. This impacts many property investors who are purchasing properties that have been mismanaged, charge below market rents, need renovations, etc.

What we have found at AAI Financial is that changes and the level of tightening are local. For example, one market in one state may still offer 30-year amortization for a multifamily property, while in a market in another state it may be challenging to find a lender willing to offer 25 years, 20 years being more common.

Not all lenders have tightened their commercial lending. AAI Financial can identify which lenders are right for your situation in your market. We also have access to several national lenders that may be a better fit for your loan.

RECENTLY FUNDED TRANSACTIONS

Here are examples of opportunities we assisted our clients with last quarter:

- $8,000,000 Hotel Refinance – Mount Vernon, WA – 45.71% LTC

- $3,708,360 Vehicle Dealership Real Estate Purchase – Yakima, WA – 90% LTV

- $6,950,000 Industrial Construction to Perm – Richland, WA – 85% LTC Plus Equity Earn Out

Contact us to learn how we can help you with your commercial property financing.

We’re Hiring!

AAI Financial Group continues to grow! We are looking for Loan Originators to join our team and participate in our continued success. For more information, email us at info@aaifg.com or view our career opportunities here.

Let's talk.

We are knowledgeable, easy to talk to, and give free advice.

Please contact us to see how we can work together.

Or email us.