The Trump administration has shifted focus from interest rates to tariffs, taxes, and policy changes. Please enjoy our quarterly newsletter on how this affects commercial real estate, borrowing rates and more.

COMMERCIAL REAL ESTATE NEWS

Tariffs, Taxes and Deregulation Make Real Estate Waves

Like surfers waiting for the perfect wave, experienced real estate investors know that success — or a wipeout — often comes down to timing. In 2025, deregulation, surging interest rates and a volatile insurance market are likely to create swells of opportunity and potential rip tides.

Read the full article from WIPFLI here.

Navigating Interest Rate Uncertainty

Since the election, the market has tried to answer the question: Will the new administration’s policy proposals increase inflation? In doing so, the market has swung back and forth, adding to bond volatility.

Read the full article from J.P. Morgan Insights here.

Higher Construction Materials Prices Coming

Yield Pro compiled the BLS reported changes for our standard list of construction materials prices. These are prices of materials which directly impact the cost of constructing an apartment building.

Read the full article from Yield Pro here.

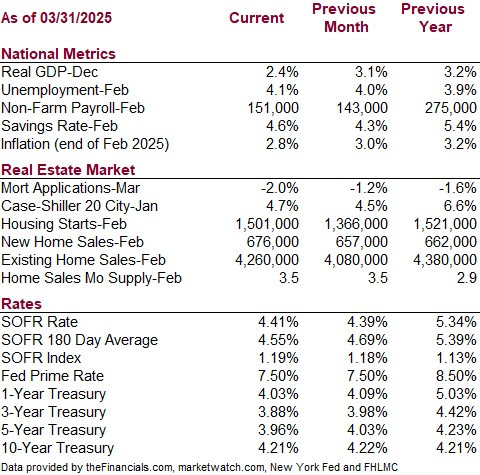

ECONOMIC DATA

BORROWING TRENDS

Understanding Stagflation: Causes, Historical Precedents and Responses

Recently, the word Stagflation has entered several news articles, fueled by rising inflation expectations, mainly due to tariffs, and slowing economic growth. Stagflation is an unusual and challenging economic condition characterized by the simultaneous occurrence of stagnation and inflation. Specifically, it refers to a situation where an economy experiences sluggish or stagnant growth, high unemployment, and rising inflation rates at the same time. This economic predicament is particularly troublesome because the traditional policy tools for fighting unemployment often worsen inflation, while anti-inflation measures frequently deepen unemployment.

Historical Occurrences of Stagflation

One of the most notable instances of stagflation occurred in the 1970s in the United States and other Western economies. During this period, a series of oil price shocks—primarily driven by the OPEC oil embargo and geopolitical tensions—led to skyrocketing energy prices. Coupled with declining industrial productivity and a slowing economy, this gave rise to stagflation. The 1970s episode shattered the prevailing belief that inflation and unemployment were inversely related, forcing economists to reevaluate their theories and policymakers to rethink their strategies.

The United Kingdom experienced a similar phenomenon in the 1960s, coining the term “stagflation.” Japan faced a milder version during its “Lost Decades” beginning in the 1990s.

Impact on Interest Rates and Borrowing

Stagflation places central banks in a difficult position when setting interest rates. Under normal circumstances, high inflation prompts central banks to increase interest rates to control rising prices. However, during stagflation, an economy is also grappling with low growth and high unemployment. Raising interest rates in this context can further stifle economic activity, making borrowing more expensive for businesses and consumers, and reducing investment and spending. On the other hand, lowering interest rates to stimulate the economy risks worsening inflation, creating a vicious cycle.

For borrowers, stagflation can result in a challenging environment. If interest rates are increased, loans for businesses and individuals become costlier, leading to reduced access to credit. Additionally, inflation erodes purchasing power, making it harder for borrowers to meet their obligations. The result is a borrowing environment where capital becomes both more expensive and less accessible, particularly affecting small businesses and potential homebuyers.

Government Interventions to Control Stagflation

Addressing stagflation requires a delicate balancing act, as traditional monetary and fiscal policies may have conflicting effects. Here are some common approaches governments might take:

1. Supply-Side Reforms: By focusing on increasing productivity and efficiency, governments can help reduce inflationary pressures and stimulate growth. For example, deregulation, investing in infrastructure, education, and technology can boost long-term economic output.

2. Targeted Monetary Policies: Central banks may adopt more nuanced approaches, such as targeting specific sectors or using tools like quantitative easing to provide liquidity without driving inflation too high.

3. Controlled Fiscal Stimulus: Governments may implement targeted fiscal policies, such as tax cuts or subsidies, to support struggling industries or households without significantly worsening inflation.

Stagflation complicates the relationship between borrowing and interest rates, as traditional approaches to combating inflation or stimulating growth often fail to address both issues simultaneously. For businesses and consumers, navigating such an environment means higher borrowing costs and limited access to credit. Policymakers must therefore strike a delicate balance, employing innovative strategies to stabilize the economy while mitigating the adverse effects on borrowing and financial stability.

This article was prepared with the help of AI.

RECENTLY FUNDED TRANSACTIONS

Here are some of the opportunities we assisted our clients with last quarter:

- $3,347,068 Medical Equipment – Las Vegas, NV – 100.00% LTV

- $2,539,441 Multifamily – Ecorse, MI – 75.00% LTV

- $900,000 Non-Profit Line of Credit – Ellensburg,WA

Contact us to learn how we can help you with your commercial property financing.

Let's talk.

We are knowledgeable, easy to talk to, and give free advice.

Please contact us to see how we can work together.

Or email us.