Economic uncertainty continues to define the landscape, with lingering questions around inflation, tariffs, and the labor market. Will the government’s efforts to counterbalance these risks, such as the Fed lowering interest rates or HUD’s recent cut to multifamily mortgage insurance premiums be enough to steady the course? In this issue, we examine how these forces converge to shape lending trends, interest rates, and strategic decisions across the commercial real estate sector.

COMMERCIAL REAL ESTATE NEWS

Construction Materials Prices Rise as Steel Rolls Higher

The producer price index (PPI) report from the Bureau of Labor Statistics (BLS) stated that construction materials prices rose 0.3 percent month-over-month in August on a seasonally adjusted basis. The intermediate demand index of components and materials for construction was up 2.7 percent from its year-earlier level.

Read the full article on Yield Pro

HUD Cuts All Multifamily Mortgage Insurance Premiums to 25 Basis Points

The Department of Housing and Urban Development (HUD) announced it would reduce MIPs to 25 basis points – the statutory minimum the agency must charge – early this summer. To put this reduction into context, multifamily MIPs ranged from 25 basis points up to 95 basis points unless the project was part of a special program.

Read the full article on National Association of Home Builders

5 Tips for Marketing Multifamily Properties in Uncertain Times

During economic uncertainty and market volatility, marketing your multifamily properties may not seem like a top priority. However, it’s precisely during these times that a well-crafted multifamily marketing plan matters most.

Read the full article on J.P.Morgan Insights

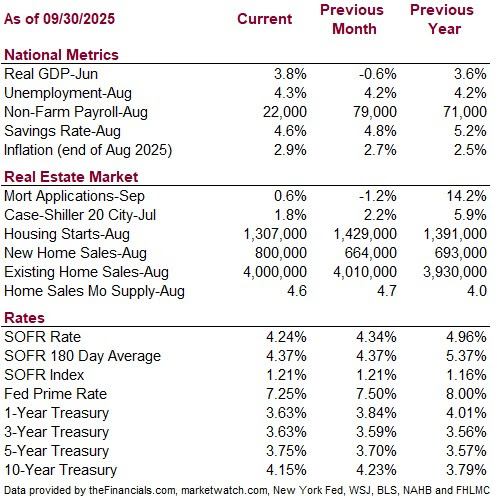

ECONOMIC DATA

BORROWING TRENDS

Understanding Interest Rates in a Shifting Market

The Federal Reserve lowered interest rates by a quarter point on September 17, reducing the federal funds target range to 4.00%–4.25%. Yet, in the days following the announcement, residential mortgage rates and the five- and ten-year Treasury yields, benchmarks for many commercial mortgage loans, rose. This divergence has prompted questions from clients about why long-term rates moved higher and what it means for future commercial borrowing. We published a similar article in our newsletter in the second quarter of 2024 and felt it would benefit clients to update the article for the current rate environment.

When the Fed raises or lowers interest rates, it directly impacts short-term rates, like the federal funds rate and the Prime Rate. However, the effects on long-term rates, such as those for mortgages and corporate bonds, are more complex and depend on several factors.

Short-Term Rates: The Fed’s rate decisions have a direct impact on short-term interest rates, such as the federal funds rate and the Prime Rate. The Prime Rate typically tracks about 3 percentage points above the federal funds rate, which is why it currently sits at 7.25%. Many short-term or revolving loans—like SBA 7(a) variable-rate loans, operating lines of credit, credit cards, and HELOCs—are tied to Prime and adjust accordingly.

Long-Term Rates: Long-term rates, including 5- and 10-year Treasury yields, are shaped by market expectations, not Fed mandates. Investors price long-term debt based on anticipated future short-term rates, inflation expectations, and a risk premium for duration. These rates serve as key benchmarks for commercial mortgage pricing.

Although the September rate cut was widely anticipated and already priced into markets, recent inflation data and Fed projections have shifted sentiment. The Fed’s updated outlook suggests slightly faster inflation in 2026, reducing the likelihood of additional cuts and nudging long-term rates higher.

Supply and Demand Dynamics: Beyond expectations, long-term rates respond to supply and demand in debt markets. If demand for Treasurys wanes, sellers must offer higher yields to attract buyers. Conversely, strong demand pushes prices up and yields down. This dynamic is especially relevant as the Fed continues its balance sheet reduction program.

The Fed’s Role: The Fed’s balance sheet reduction program plays a significant role in long-term rate determination. During the COVID-19 pandemic, the Fed was a major buyer of U.S. Treasurys and mortgage-backed securities, creating demand and keeping long-term rates low. Now, as the Fed allows these securities to roll off their balance sheet without reinvesting the proceeds, sellers must find other buyers, potentially needing to increase yields to entice demand. If the Fed were to actively sell these securities, it could flood the market with supply, further driving up long-term rates.

Recent Rate Influences: The Fed’s “Dot Plot”—a chart of individual policymakers’ rate forecasts—currently shows two more rate cuts expected in 2025, but only one in 2026, while markets anticipate three. This disconnect contributes to upward pressure on long-term rates, as investors recalibrate expectations.

Other Influences: The full impact of tariffs may not yet be reflected in the inflation numbers. If inflation rises and the Fed holds short-term rates steady—or hikes them to combat price growth—long-term rates will likely increase. Meanwhile, although unemployment remains low, sector-specific job losses could prompt the Fed to ease rates again if broader economic weakness emerges.

Interest rates continue to respond to a wide range of influences, from inflation data and policy signals to shifts in investor sentiment and global economic conditions. While short-term rates reflect the Federal Reserve’s decisions, long-term rates are shaped by broader market forces and expectations. For borrowers, the key is to stay informed and work with trusted advisors who understand how these dynamics affect financing options. Rather than trying to predict where rates will go, AAI Financial focuses on helping clients navigate the current environment to obtain the best loan terms and structure.

This article was prepared with the help of AI.

RECENTLY FUNDED TRANSACTIONS

Here are some of the opportunities we assisted our clients with last quarter:

- $13,250,000 Travel Center Construction Takeout, USDA – Wapato, WA – 66.25% LTV

- $7,150,000 Hotel Construction to Perm – Ephrata, WA – 63.27% LTV

- $1,340,000 Multifamily Refi – Greenville, IN and Louisville, KY – 72.00% LTV

Contact us to learn how we can help you with your commercial property financing.

Let's talk.

We are knowledgeable, easy to talk to, and give free advice.

Please contact us to see how we can work together.

Or email us.