Rising real estate taxes and insurance premiums are placing added pressure on property owners, while the broader economy continues to grapple with tariff impacts and persistent inflationary concerns. In this issue, we explore how these forces intersect to shape commercial real estate trends, borrowing conditions, and the outlook for investors and lenders alike.

COMMERCIAL REAL ESTATE NEWS

Why Tariffs Could ‘Break’ the Construction Industry

The U.S. construction industry is barreling toward a crisis that could cripple growth for a decade or more. President Trump’s newly imposed tariffs may be the tipping point that transforms today’s slow-burning struggle for the industry into a full-scale breakdown. The danger is not theoretical. The cracks are already forming.

Read the full article from Commercial Property Executive

How Multifamily Investors Can Prepare For A Recession

Experts from JPMorgan Chase and Moody’s Analytics explain why the economy is teetering on a recession and offer tips for multifamily investors.

Read full article from JPMorgan Chase Insights

3 Tips to Lower Your Commercial Real Estate Insurance Costs

Commercial property insurance costs are on the rise—and on track to increase nearly 80% by 2030. Al Brooks, Vice Chair of Commercial Banking at J.P. Morgan, details how to reduce costs.

Read full article from JPMorgan Chase Insights

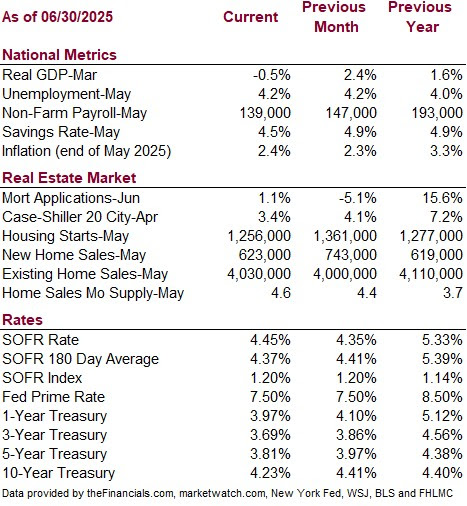

ECONOMIC DATA

BORROWING TRENDS

Making Money in Multifamily Real Estate Amid Rising Costs and New Regulations

Multifamily real estate has long been a favored asset class for investors seeking stable cash flow and long-term appreciation. But in today’s environment, profitability is being squeezed by two powerful forces: surging insurance and property tax costs, and a wave of new landlord regulations, particularly in states like Washington.

The Cost Crunch

Insurance premiums for multifamily properties have skyrocketed in recent years. In some markets, premiums have doubled or even tripled due to increased natural disasters, social inflation (i.e., rising litigation costs), and insurers pulling out of high-risk areas. Property taxes have also climbed steadily, driven by rising property valuations and local government budget pressures. Together, these fixed costs are eroding net operating income (NOI), making it harder for landlords to maintain margins—even as rents rise.

Regulatory Headwinds in Washington

Other challenges come in the form of regulation. For example, Washington State has introduced several new laws that directly impact landlord profitability:

- Statewide Rent Control (HB 1217): Caps annual rent increases at the lesser of 7% plus inflation or 10%, with a 5% cap for manufactured homes. Rent hikes are banned in the first year of tenancy, and landlords must give 90 days’ notice for increases.

- Ban on Algorithmic Rent-Setting Tools: Seattle recently banned software like RealPage that uses data to recommend rent prices, citing antitrust concerns.

- Certified Mail Requirements: Landlords must now send certain notices (e.g., rent increases, lease terminations) via certified mail postmarked within Washington, adding administrative burden and cost.

These laws aim to protect tenants but can limit landlords’ flexibility to respond to rising expenses.

How to Stay Profitable

Despite these challenges, savvy investors can still make money in multifamily real estate by adapting their strategies:

1. Focus on Operational Efficiency: Implement energy-efficient upgrades, reduce maintenance costs through preventative programs, and explore technologies like remote video surveillance to lower insurance premiums.

2. Appeal Property Tax Assessments: Many jurisdictions allow owners to contest property valuations. Regularly review assessments and file appeals when warranted.

3. Explore Alternative Financing and Insurance Structures: Consider higher deductibles, catastrophe bonds, or joining insurance risk pools to manage premium costs.

4. Invest in Resilient Markets and Assets: Target properties in areas with lower regulatory burdens or those exempt from rent caps (e.g., new construction in Washington is exempt for 12 years).

5. Add Value Strategically: Renovate units to justify higher rents within legal limits, or add amenities that increase tenant retention and reduce turnover costs.

Multifamily investing is no longer a passive income play—it requires active management, legal awareness, and creative problem-solving. But for those willing to adapt, opportunities still abound.

AAI Financial Group can assist you by reviewing your portfolio, providing profitability insight, and assisting in refinancing, purchasing and selling your real estate.

RECENTLY FUNDED TRANSACTIONS

Here are some of the opportunities we assisted our clients with last quarter:

- $2,507,500 Gas Station SBA 504 Purchase – Eugene, OR – 79.60% LTV

- $1,062,600 Hardware Store Purchase – Mossyrock, WA – 75.79% LTV

- $3,320,335 Gas Station Construction to Perm – Othello,WA – 64.22% LTV

Contact us to learn how we can help you with your commercial property financing!

Let's talk.

We are knowledgeable, easy to talk to, and give free advice.

Please contact us to see how we can work together.

Or email us.