Performance-Linked Loans Align Borrowers, Lenders

(Article courtesy of Commercial Property Executive)

Lenders and borrowers are increasingly working together to create performance-linked arrangements that align incentives and make projects viable even in uncertain conditions. These structures allow both parties to share in success while maintaining prudent safeguards against downside risk.

read more…

Why Are Commercial Property Insurance Premiums Increasing?

(Article courtesy of Univest)

In recent years, property insurance has undergone significant changes, driven by a complex mix of economic, environmental and societal factors. From pandemic-induced supply chain disruptions to the increasing frequency of catastrophic weather events, these cost drivers have reshaped the insurance market and impacted premiums across the board. Understanding the forces behind past increases and current trends is essential to maximize coverage and control costs.

read more…

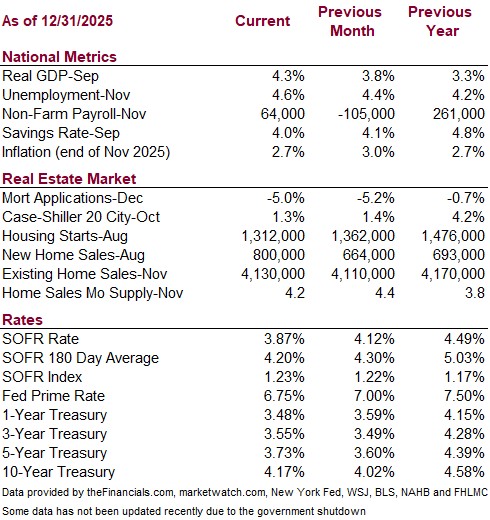

ECONOMIC DATA

BORROWING TRENDS

Strengthening Your Borrower Profile: Tips to Secure Better Commercial Loan Terms in 2026

Commercial lending standards are tighter heading into 2026 than at any point in the past decade. Banks, credit unions, and private lenders are all applying stricter underwriting, deeper cash flow analysis, and more conservative leverage limits. With a historic volume of commercial real estate and business loans maturing over the next 24 months, borrowers who prepare thoroughly will have a clear advantage. Strong preparation doesn’t just improve approval odds — it directly leads to lower rates, higher leverage, and faster closings.

Below are the most important steps borrowers can take to strengthen their profile and secure better loan terms in 2026, along with how AAI Financial Group can support each stage of the process.

1. Improve Your DSCR: The Metric Lenders Prioritize Most

Debt Service Coverage Ratio (DSCR) remains the core measure of repayment strength. Even small improvements can shift a borrower from a marginal approval to a competitive offer.

Practical ways to improve DSCR:

- Increase NOI through rent optimization and expense reduction

- Lock in predictable operating costs through service contracts

- Pay down small high interest obligations to reduce monthly debt load

- Avoid taking on new liabilities before applying

How AAI Financial Group helps:

We will pre-underwrite your request, reviewing DSCR, global cash flow, and stress tested scenarios before it ever reaches a lender. Borrowers receive clear guidance on how to strengthen DSCR and understand exactly how lenders will view their numbers.

2. Strengthen Your Credit Profile

With lenders more cautious, credit quality plays a larger role in pricing and structure.

Steps to improve creditworthiness:

- Reduce revolving balances to improve utilization

- Resolve small derogatory items

- Avoid opening new accounts before applying

- Prepare explanations for any one time credit events

How AAI Financial Group helps:

We provide credit profile reviews and practical recommendations to improve borrower strength before submission. This ensures your credit story is clear, accurate, and positioned favorably.

3. Upgrade Your Cash Flow Documentation

In 2026, documentation quality is a competitive advantage. Lenders expect complete, organized, and verifiable financials.

Strong documentation includes:

- Trailing 12 month P&L

- Rent roll and leases

- Bank statements that reconcile cleanly

- Liquidity summary

- Tax returns aligned with reported income

How AAI Financial Group helps:

We provide detailed documentation checklists tailored to each loan type — SBA, bridge, DSCR, construction, or conventional CRE. Our borrowers know exactly what is required, reducing delays and eliminating back and forth with lenders.

4. Use Technology and AI to Strengthen Your Application

Lenders increasingly rely on automated underwriting, digital verification, and AI driven cash flow analysis. Borrowers who mirror this level of sophistication stand out.

Practical tech advantages:

- Automated bookkeeping for clean financials

- AI based cash flow forecasting

- Digital document vaults for secure sharing

- Expense categorization tools to identify NOI improvements

How AAI Financial Group helps:

We package your request using secure digital delivery, ensuring lenders receive clean, organized, and complete files in formats that integrate smoothly with their underwriting systems. This reduces friction and accelerates approvals.

5. Prepare Early and Communicate Proactively

In a tight lending environment, preparation is leverage. Borrowers who engage early and present a complete, well organized package consistently receive better outcomes.

Strong preparation can lead to:

- Faster approvals

- Lower interest rates

- Higher leverage

- More flexible structures

- Better negotiating power

How AAI Financial Group helps:

AAI acts as your front end underwriting partner, reviewing DSCR, cash flow, forecasts, credit, and collateral before the file reaches a lender. By submitting a fully packaged, professionally underwritten request, borrowers reduce perceived risk — and lenders reward that with stronger terms.

2026 will reward borrowers who treat financing as a strategic process, not a last minute task. By improving DSCR, strengthening credit, tightening documentation, and embracing technology, borrowers can position themselves as low risk, high credibility partners. With AAI Financial Group guiding the process — from documentation checklists to pre underwriting to secure digital packaging — borrowers gain a meaningful advantage in a competitive lending environment.

RECENTLY FUNDED TRANSACTIONS

Here are some of the opportunities we assisted our clients with last quarter:

- $636,000 Business Purchase, SBA – Yakima, WA – 67.95% LTV

- $6,150,000 Townhome Construction to Perm – Yakima, WA – 60.33% LTV

- $1,845,000 Multifamily Purchase – Spokane, WA – 75.31% LTV

Contact us to learn how we can help you with your commercial property financing.

Let's talk.

We are knowledgeable, easy to talk to, and give free advice.

Please contact us to see how we can work together.

Or email us.